As CISSP students, you know that managing risk is one of the most critical aspects of securing information systems. But risk management isn’t just about securing assets and preventing incidents — it’s also about understanding the financial responsibility associated with the choices we make in securing our environments. We have to grasp some basic concepts in order to assess, prioritize, and mitigate risks.

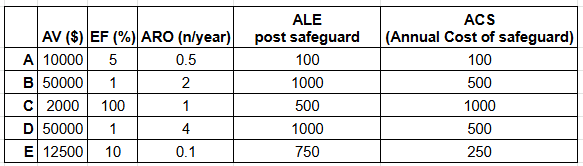

In this article, we’ll dive deep into several important concepts related to risk analysis: AV, EF, ARO, ALE, ALE post-safeguard, and ACS. These terms provide a structured way to quantitatively measure, assess, and communicate risk in a business environment.

AV (Asset Value)

At the foundation of any risk management strategy is understanding the value of your assets — be they data, systems, or intellectual property. The Asset Value (AV) refers to the financial worth of a particular asset to an organization. It’s an important starting point because, without knowing the value of the asset, we can’t do much, actually we can just bullshit around. For example, the value of a company’s proprietary database of customer information will likely be much higher than a simple internal document. This distinction is critical because when a threat impacts an asset, its financial loss could vary widely based on its value. And estimating an assat value is such a big deal.

At the foundation of any risk management strategy is understanding the value of your assets — be they data, systems, or intellectual property. The Asset Value (AV) refers to the financial worth of a particular asset to an organization. It’s an important starting point because, without knowing the value of the asset, we can’t do much, actually we can just bullshit around. For example, the value of a company’s proprietary database of customer information will likely be much higher than a simple internal document. This distinction is critical because when a threat impacts an asset, its financial loss could vary widely based on its value. And estimating an assat value is such a big deal.

EF (Exposure Factor)

EF is the percentage of the asset value that is likely to be lost during a specific incident. For example, if an attacker were to gain access to the customer database mentioned earlier, and the database were to be compromised, the EF could be set at 100% (meaning the asset is entirely lost or becomes useless). However, if the attack only causes partial damage, the EF might be lower than 50%. Understanding EF helps you estimate the potential impact of a security breach on each asset. The higher the EF, the more costly the breach will be.

EF is the percentage of the asset value that is likely to be lost during a specific incident. For example, if an attacker were to gain access to the customer database mentioned earlier, and the database were to be compromised, the EF could be set at 100% (meaning the asset is entirely lost or becomes useless). However, if the attack only causes partial damage, the EF might be lower than 50%. Understanding EF helps you estimate the potential impact of a security breach on each asset. The higher the EF, the more costly the breach will be.

ARO (Annual Rate of Occurrence)

AV and EF help us understand the potential impact of a risk, ARO is about frequency. The Annual Rate of Occurrence (ARO) refers to how often an incident is expected to occur within a year. This helps organizations anticipate the likelihood of risk events and plan their mitigation strategies accordingly. For example, if you estimate that a certain type of attack or incident happens once every three years, the ARO for that event would be 0.33 (1/3). On the other hand, if it’s expected to happen once every year, the ARO would be 1. The ARO helps you calculate the probability of a risk happening and aids in evaluating whether it’s worth investing in a countermeasure.

AV and EF help us understand the potential impact of a risk, ARO is about frequency. The Annual Rate of Occurrence (ARO) refers to how often an incident is expected to occur within a year. This helps organizations anticipate the likelihood of risk events and plan their mitigation strategies accordingly. For example, if you estimate that a certain type of attack or incident happens once every three years, the ARO for that event would be 0.33 (1/3). On the other hand, if it’s expected to happen once every year, the ARO would be 1. The ARO helps you calculate the probability of a risk happening and aids in evaluating whether it’s worth investing in a countermeasure.

ALE (Annual Loss Expectancy)

ALE provides a way to quantify risk in financial terms by calculating the expected annual loss due to a particular threat. The formula for ALE is:

ALE=AV×EF×ARO

For example, if the value of the asset (AV) is $100,000, the exposure factor (EF) is 50%, and the annual rate of occurrence (ARO) is 1 (meaning the event is expected to happen once a year), the ALE would be:

ALE=100,000×0.50×1=50,000

This means that, on average, the company could lose $50,000 per year due to this specific (meaning this specific threat exploiting a vulnerability of this specific asset).

ALE provides a way to quantify risk in financial terms by calculating the expected annual loss due to a particular threat. The formula for ALE is:

ALE=AV×EF×ARO

For example, if the value of the asset (AV) is $100,000, the exposure factor (EF) is 50%, and the annual rate of occurrence (ARO) is 1 (meaning the event is expected to happen once a year), the ALE would be:

ALE=100,000×0.50×1=50,000

This means that, on average, the company could lose $50,000 per year due to this specific (meaning this specific threat exploiting a vulnerability of this specific asset).

ALE Post-Safeguard

Once a safeguard or countermeasure is implemented to mitigate a risk, it’s crucial to understand how effective that countermeasure is at reducing potential losses. ALE Post-Safeguard helps you assess the reduced risk after implementing a safeguard. Essentially, it’s a recalculated ALE that considers the impact of the safeguard in reducing the exposure to the asset. (note: An effective countermeasure is one that reduces the EF and/or the ARO) For example, if the safeguard reduces the exposure factor (EF) from 50% to 20%, the ALE Post-Safeguard would be significantly lower. Let’s assume that after implementing the safeguard, the new EF is 20%. With the same AV and ARO values as before, the new ALE would be:

ALE Post-Safeguard=100,000×0.20×1=20,000

In this case, the safeguard reduces the potential loss from $50,000 to $20,000 annually. This demonstrates the financial effectiveness of the safeguard.

Once a safeguard or countermeasure is implemented to mitigate a risk, it’s crucial to understand how effective that countermeasure is at reducing potential losses. ALE Post-Safeguard helps you assess the reduced risk after implementing a safeguard. Essentially, it’s a recalculated ALE that considers the impact of the safeguard in reducing the exposure to the asset. (note: An effective countermeasure is one that reduces the EF and/or the ARO) For example, if the safeguard reduces the exposure factor (EF) from 50% to 20%, the ALE Post-Safeguard would be significantly lower. Let’s assume that after implementing the safeguard, the new EF is 20%. With the same AV and ARO values as before, the new ALE would be:

ALE Post-Safeguard=100,000×0.20×1=20,000

In this case, the safeguard reduces the potential loss from $50,000 to $20,000 annually. This demonstrates the financial effectiveness of the safeguard.

ACS (Annual Cost of Safeguard)

The Annual Cost of Safeguard (ACS) refers to the total cost incurred by an organization to maintain a security safeguard or countermeasure over the course of a year. This includes expenses related to the implementation, maintenance, and management of security solutions like firewalls, intrusion detection systems, or training programs. When considering whether to implement a safeguard, organizations must compare the ACS to the ALE and ALE post-safeguard to determine if the investment in security measures is worthwhile. If the ACS is less than the difference between the ALE and the ALE Post-Safeguard, then the safeguard is -financially- justified. In the context of risk management, it’s not just about reducing risk — it’s about doing so cost-effectively. Understanding how to balance the cost of safeguards with the expected financial loss from potential breaches is crucial for any organization. The financial responsibility in managing risk lies in understanding the true cost-benefit of security investments. A safeguard that costs more than the potential loss it mitigates isn’t a smart financial decision. However, implementing a safeguard with a reasonable ACS that significantly reduces the ALE can be a wise investment that helps secure the organization while keeping costs manageable.

The Annual Cost of Safeguard (ACS) refers to the total cost incurred by an organization to maintain a security safeguard or countermeasure over the course of a year. This includes expenses related to the implementation, maintenance, and management of security solutions like firewalls, intrusion detection systems, or training programs. When considering whether to implement a safeguard, organizations must compare the ACS to the ALE and ALE post-safeguard to determine if the investment in security measures is worthwhile. If the ACS is less than the difference between the ALE and the ALE Post-Safeguard, then the safeguard is -financially- justified. In the context of risk management, it’s not just about reducing risk — it’s about doing so cost-effectively. Understanding how to balance the cost of safeguards with the expected financial loss from potential breaches is crucial for any organization. The financial responsibility in managing risk lies in understanding the true cost-benefit of security investments. A safeguard that costs more than the potential loss it mitigates isn’t a smart financial decision. However, implementing a safeguard with a reasonable ACS that significantly reduces the ALE can be a wise investment that helps secure the organization while keeping costs manageable.

Test your knowledge

In what scenarios implementing the safeguard is not a financially responsible choice ?

In what scenarios implementing the safeguard is not a financially responsible choice ?

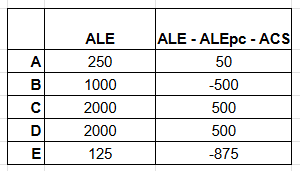

(Quick) Answer to the “Test your knowledge question”

Here in the table below we found the ALE and the (ALE pre safeguard — ALE post safeguard — ACS) value, the latter represents the value of the safeguard to the company that must be >0 for a financially responsible choice.

Here in the table below we found the ALE and the (ALE pre safeguard — ALE post safeguard — ACS) value, the latter represents the value of the safeguard to the company that must be >0 for a financially responsible choice.

Want more quality and challenging CISSP questions ? This one is the place to be: https://www.udemy.com/course/cissp-2025-the-complete-exam-simulation-question-bank/?referralCode=B747EB5154359E76CF00

Want to dig a bit deeper into the concept of risk in cybersecurity ? Give a look here: https://www.theinfosecvault.com/2022/05/05/what-is-the-best-definition-of-risk/